The Boom and Bust Art Market Speculation

Be very suspicious of the long-term financial value of “ultracontemporary” these are very early career artists whose work is selling above 10k. The bull market for fine art has always been highly speculative, and the art market has been in a downturn for the last couple years. I would argue that this downturn is just a market correction for the irrational exuberance of the 2021 $712 million spent at art auction. The $259 million spent at auction in 2020 is closer to the standard range for the current art auction market. The majority of the art work sold in 2021 at auction was mostly spent on “ultracontemporary” artists, this catch all term for artists born after 1974 is very deceptive as there are quite a few contemporary artists who have long established (over ten years) solid well managed careers that range between 7 to 12 years of gallery shows. These artist have been careful not to flood the market with their work. Those early career artists are very different from the infant “ultracontemporary”career, fresh out of art school or amature artists who are self-taught.

As the art market corrects it will set back the careers of young artist who boomed too early and then suddenly busted. As the speculative money leaves the market, the correction really hits the most auction inflated artist values harder than other more established artist who have loyal invested collectors, and smart gallery representation. The issue is that work which had its value reset from ten to twenty thousand a piece by art auctions will have there gallery representation try to reset there work values 10-30% higher than auction range to around 25 to 50 thousand. The gallery does not want to lose their investment and there cut of the 50% commission that at one time was on $100 to $200 thousand per piece artwork. The galleries that represent more valuable artists also have there reputations at risk when sudden price plunges occur, the collectors who trusted a galleries advise will question all of the artists represented by the gallery. The boom/bust ultracontemporary artist will have there work showing at a gallery that is not accessible to the middle class art market and will have there prices set too high for the pocketbooks of the not very rich collectors which are the majority of the art market. The smart collectors will not risk spending that much for an undercut artists work, because it still too high for an artist whose career has not reached those values gradually overtime by building momentum through years of successful gallery and museum shows.

All artist are vulnerable to market volatility and the irrational exuberance caused by the secondary art market especially Art Auctions. The first time the art auction market lists a new artists work, it just reacts like wow look at that new cool thing, I want one. Auction collectors are different from gallery and direct artist collectors like myself. “More than a third of buyers at Christies and Sothebys in 2021 were new clients that were more interested in turning a quick profit than becoming lifelong patons” _ insert citation The 2021 boom was almost entirely driven by art auction buyers who were buying artwork with a misplaced belief in quick returns. Most new Art auction bidders are completely new to the art market in general and tend to not have the experience eye of someone who has had to acquire art by attending art events, gallery shows, and following the careers of artist sovertime. Most new art auction bidders are less familiar with the art markets biggest artists and its power players like top tier galleries. The auctions bidding style lends itself to competitive bidding behavior that has nothing to do with the artwork being sold, it is human psychology.

Art pricing is generally very speculative, as owning art is not one of life’s necessity. Prices are mostly subjective as pricing at its core is set by many individual's willingness to pay a certain price for a certain artists work. Sure, larger artworks: paintings and sculptures tend to be priced higher than smaller work. Unfortunately there is no current full proof mathematical formula that ranks artists and predicts pricing trends for fine art. Print and social media attention on the record high art auction prices and artists who attain record auction prices tend to hype their auction records. The availability of easy credit, a strong labor market and economy plus low interest rates also can cause art prices to rise.

The stock brokers and some Mega collectors in the fine art market tend to use Fine art as vehicle of financial speculation and the quick money scam. Art selling below the gallery set value is often sold directly to collectors in off market sales, art that sells privately does not effect the pubic face value of an artists work. Collectors or speculators will buy for cheap five to twenty pieces of an artists work direct from the artists and then turn around flip them to art auctions in a short space of time. When work by any artist floods the market to the extent that supply outstrips demand, prices will subsequently collapse as faint hearted collectors offload the artist work at auction. The art market is still correcting as 2023 prices for new artist work or “ultracontemporary” art has continued to drop by almost a third or by about 39 percent over last year, as speculators continue to sell off there over priced work and take massive losses. Smarter artist manage there collectors as well as the amount of paintings up for sale or privately sold, an artist should not be selling multiple pieces to any single collector, and if they do they had better have a very close personal relationship with the collector. When artist are managed well by their galleries the artist prices are hidden and only available to serious buyers with established reputations who contact the galleries directly for purchase information.

The Contemporary art market is very tied to the economy and the stock market they have a complementary relationship, this is only more so due to globalization and the global art market. Economic crashes cause art auction crashes as the art auction has always been a place where investors losing on the stock market go to recoup there financial losses via there art collection selling at auction.

The spectacular volatility of the art market is as old as the art market itself. What is different is the global money being invested in art, the huge volume of selling artists, and the short taste cycles of social media which have shortened the cycles of art tastes and art trends. Due diligence is never wasted for an experienced collector. Time invested in researching artists, even if no purchases made aids collectors in growing their taste and gaining an understanding of the current art market.

Image by vector4stock on Freepik

Collectors should look at how much unsold artwork is available for purchase online at the artists website and art galleries online. Smart collectors can research artist volume of unsold work by reaching out to the galleries that represent them or have represented them in the past in previous shows and asking what their available work is for the artist in question. Typically at that point, the gallery will send the requestor, a listing of the work that they have available-unsold. You can do this yourself for multiple artist and galleries. This will allow the collector to count the number of unsold pieces of work. It's not to say that if the artist has a significant unsold quantity that they're not worthy of your investment if you really love the work but that is a way to negotiate with the gallery in question to lower the cost of the work that you would really like to own but should not on principal overpay for. I have encountered artists who have quite a bit of unsold work, but smartly keep that work hidden behind a password on the back page of their artist website, in those back page art listings they will have work that's being held by multiple galleries, the artist is usually very happy to connect you to a piece that you like. The work that I've purchased from artist like this is almost always under $1000.

There are a few things that experienced collectors look out for when considering the work of artists who have been practicing for a very short-time or whose careers have existed for less than 5 years.

Artist who have less than 5 years of consistent and continuous practice, meaning that at minimum they should have been showing there work at galleries or at art fairs at least once per year for every year complete year of practice, this should not include college art show participation.

The artist CV and resumes in the first 5 years should show the development of their current style of work through their years long practice. Their development should be synthesizing, formulaing, and refining there individual artistic style. The subjects and thematic elements can be subject to change but you should be able to see the clear improvement, growth and refinement of the artists work. Again the first 5 years should be after art school graduation. If a practicing artist does not have a portfolio artist website and is not already famous, it is highly concerning.

The resume gives you an idea of how active the artist has been and how serious they are about their art practice you want to see a consistent record of practice. Do they regularly participate in shows and exhibitions? Are there gaps in time where the artist was not active? Consistency and regular show activities are generally what you want to see in a solid artist resume.

Artist should demonstrate that they are career driven by producing at least 10 pieces a year for a gallery or museum show. A major red flag are artists that are producing a huge amount of artwork in a short space of time, this includes artists that have over 4 to 5 gallery shows a year with over 10 pieces in each show.

For the most part an artists prices will generally rise fairly predictably for each year of productive practice and further increase after each success the artist racks up including notable one-person shows, sell-out shows, have a published monographs of their work or featuring their work, museum and press exposure. etc.

Smart career management is key for a fine artists long term success. All Artists should be treating there artwork as a commodity, when artist are mass producing artwork it is a major problem. Commodities are only valuable due to scarcity this is especially true for the art market.

Unfortunately, artist from emerging markets like Africa are very prone to art market over speculation it is especially worthwhile to seriously evaluate an emerging market ultra contemporary artist.

Don’t spend more than $1,500’s for an “ultracontemporary” artist art work unless you are very rich with money to burn. Art values breaking a thousand is not a high bar for a young artist to clear. Don’t spend more than you can afford to lose. Fine art is not a savings account or an emergency nest egg, you should not buy art if you don’t have a robust saving account and a healthy retirement account. Invest in your long-term financial stability first has art is always a luxury.

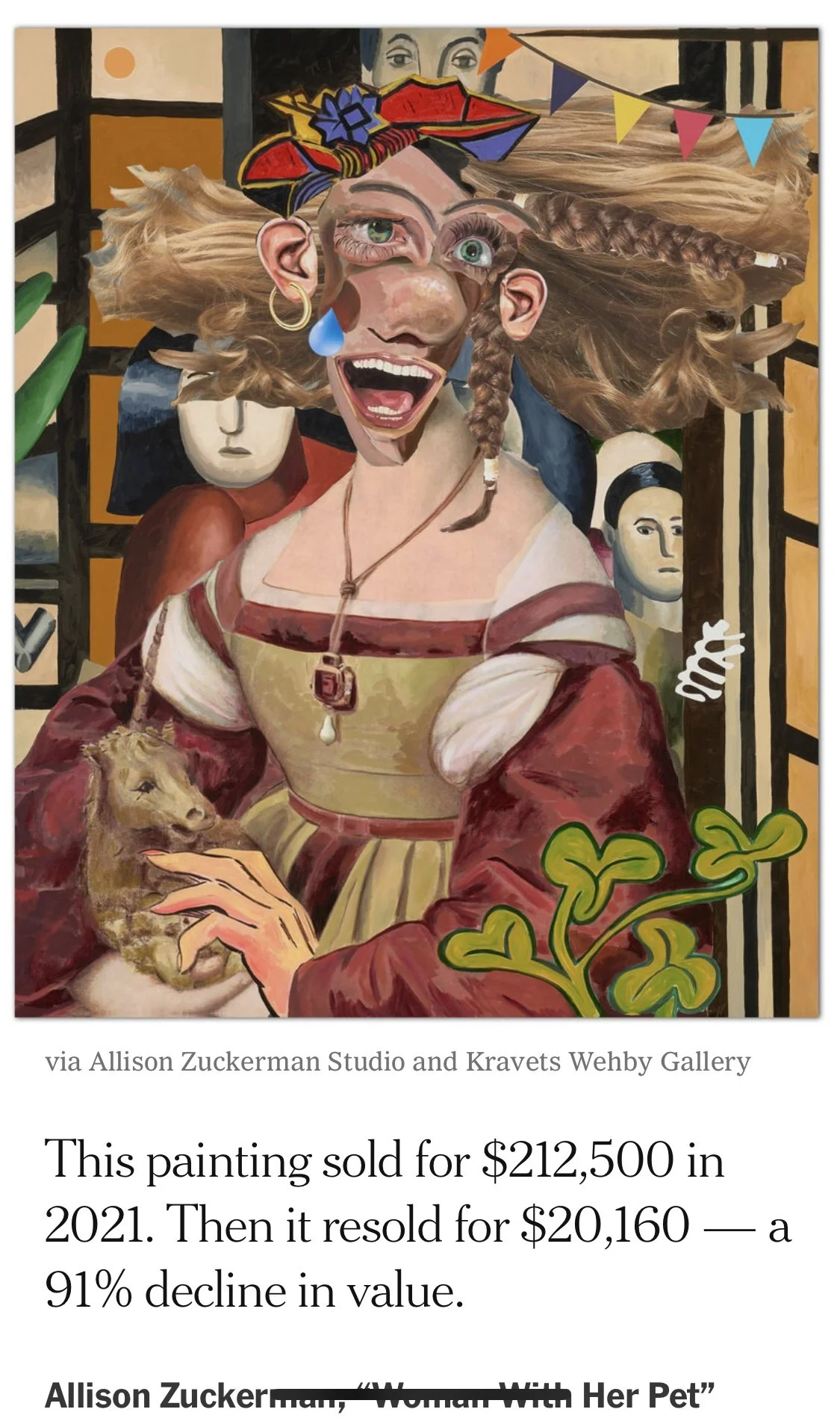

Be cautious when considering an artists work that is clearly working in a style of a famous artists or a combination of styles other artists.

If you can recognize a style of more than one artist in a work you are looking to buy you need to consider why it is so easy for you to identify: De Kooning, Picasso, and any classical renaissance painter are all present in looking at this work. If you think that is great, and you still love the work it is totally fine to go ahead and buy it, but at least take the time to evaluate an artwork for visual uniqueness of style and authorship.

The lasting artists move from hype to art history are the artist whose work is the most unique and the least derivative. Students create master copies of famous artist work as one of the basic techniques of teaching art making practice art in art school. Copying is always an amature move, so is collaging multiple artists styles, and attempting to make them your own.

There are quite a few websites that can help collectors to establish the true current financial value of an artwork outside of the auction market.

Artnet has a subscription Artnet

Price DatabaseArtsy is an excellent place to follow an artists career over years. You can create an account that will allow you to follow artists you prefer and get a notifications to your email when there work is up for sale, editorial reviews, and somethimes gallery showes. They have a non-subscription Art Price database.

Artprice allows you to Search among 849,400 artists and 17,417,900 sale prices since 1987, including 1,222,500 lots listed over the last 12 months, from 7,200 auction houses around the world.

The Smithsonian American Art Museum has a How Much Is Your Object Worth? tool for art and antiques

MutualArt has a premium membership platform geared for collectors.

After 1985 art critic verified fine art movements stopped being identified as exemplars of valuable fine art practice by the art market. The influence of fine art critics died. Long story short is that Andy Warhol factory and the Pop art movement killed fine art criticism. That has been a net positive in the sense that it has given artists who choose to paint or create art in a style outside of the academic art critics preferences or influential rich collectors tastes, opportunities to build career success and growth without being a slave to trends or styles of representation that are currently widely popular. I believe this this period of artistic pluralism has created a more unique global art market has a whole. It is important to note when there is no longer, an art expert to identify fine artworks, and valuable art movements there is no clear and clean cut way of discerning what will be guaranteed to have value in the future or what is only valuable in the moment. The number of fine artists practicing and selling work in the global art market compared to the past is really beyond historical president. The sheer volume, variety, and total number of fine artists currently practicing make finding an artist whose work will enter into annals of art histories textbooks very difficult. The only thing that I can say is that uniqueness and scarcity is key. Currently popular work being purchased by wealthy people tends to be heavily conceptual, very often ugly, traumatic, exploitative of communities, and factory artists who create art using workshop staff. The most successful artist who copy from trends are artists who have made it and don't have to be original. Only they can afford to be highly derivative and still be successful because their art works values has reached a certain threshold and they have been established in art history as top tier names. For example, these artist include Damon Hurst and Jeff Koons who are some of the art world’s most famous copiers and plagiarizers. There are very few artists who have attained the level of success that they are able to continue with an unoriginal practice.

You need a sense of humility, humanity, and morality to become a life-long art collector. You also must accept that you can buy a huge amount of artwork and not a single one of those works, may end up as a part of art history and exceptionally valuable. We hold true to our values as a collectors which is first to absolutely love the work you buy and enjoy looking at them for a long-time, Buy only one large piece or two smaller pieces of each artists work, when possible build an understanding of who the artist your investing in are as people, Having direct communication with the artists help with this, so does following there careers for a few years before and after buying work from them. Do not try to buy low with the intention of selling quickly and high, this is a vicious and problematic practice that continues to mess up peoples lives and disrupts the art market for years. We only buy what we intend to keep for a long-time and we still follow the careers of every artist we collect. Understand that the financial value of an artwork will only reach its zenith after the death of the artist and most often after the collector is also dead for contemporary fine art work. Buy work that is unique and cohesive to the collection as a whole, don’t by outliers in color or style to the extent that they look crazy in the collection, we save those for the bathroom. Never, ever spend more than you an afford on an artwork!

Bibliography

Small, Zachary, and Julia Halperin. 2024. “Young Artists Rode a $712 Million Boom. Then Came the Bust.” Nytimes.com. The New York Times. August 18, 2024. https://www.nytimes.com/2024/08/18/arts/design/young-artists-auctions-collectors.html?unlocked_article_code=1.RU4.Xkpi.s7r-bZtn6BZa&smid=nytcore-ios-share&referringSource=articleShare&tgrp=bth.